Chapter 16 The Evolution of Tax Law Design within an Increasingly Destabilized International Tax Law Framework in: Corporate Income Taxes under Pressure

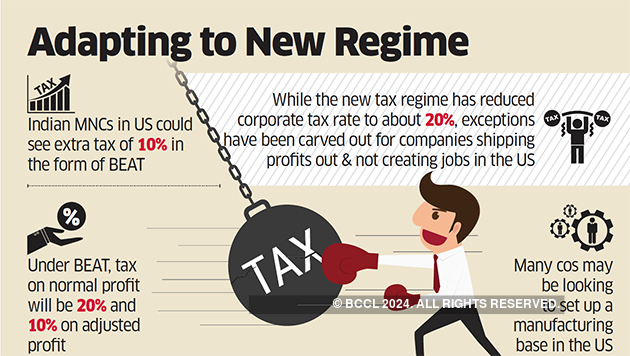

US tax reform breaks global rules, EU says | Business | Economy and finance news from a German perspective | DW | 19.12.2017

Chapter 16 The Evolution of Tax Law Design within an Increasingly Destabilized International Tax Law Framework in: Corporate Income Taxes under Pressure

Chapter 16 The Evolution of Tax Law Design within an Increasingly Destabilized International Tax Law Framework in: Corporate Income Taxes under Pressure

Proposed border tax adjustments risk violating WTO rules | International Centre for Trade and Sustainable Development